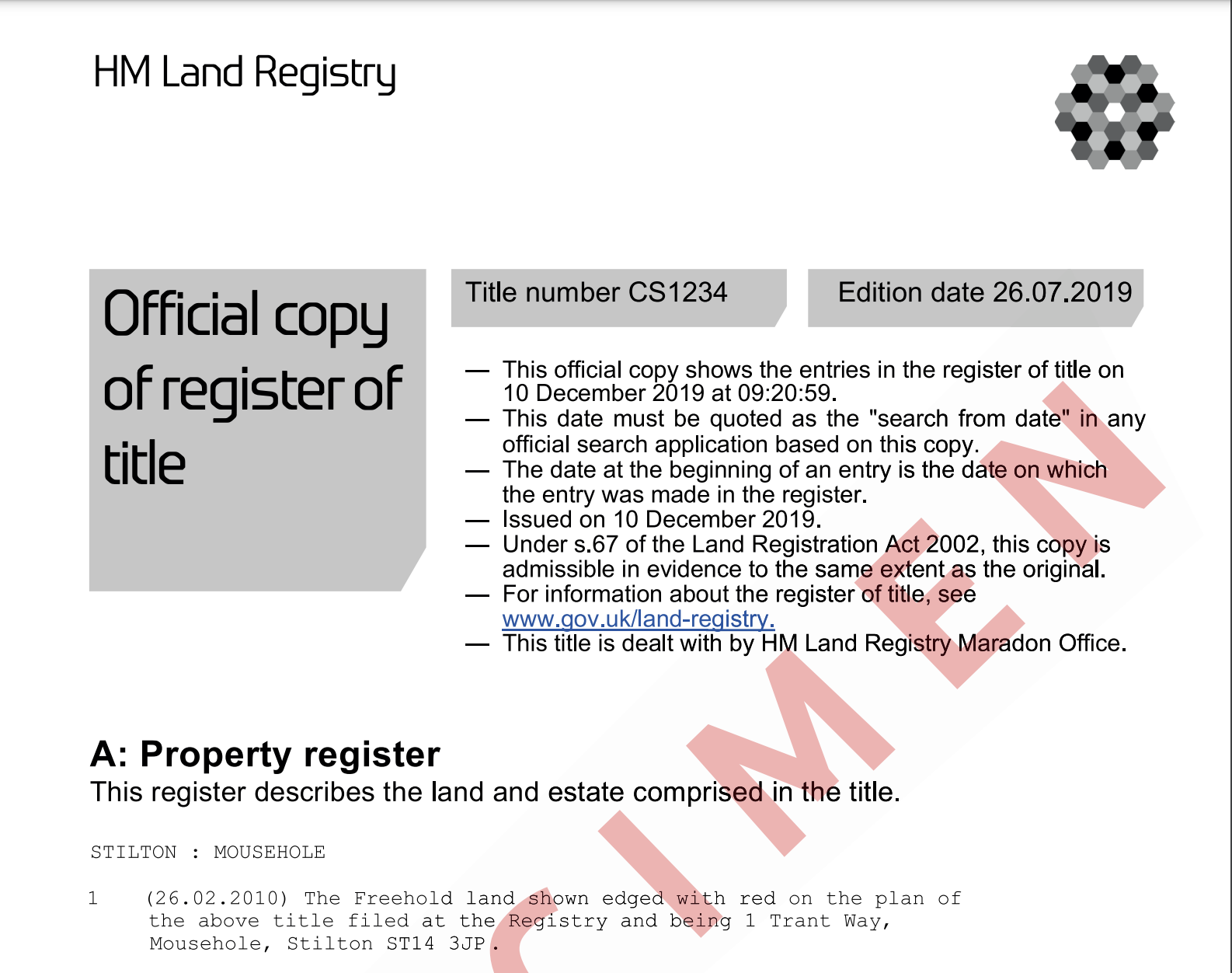

What Is a Title Register?

A HM Land Registry Title Register is an important official document that proves ownership of a property, verifies land boundaries, and identifies any rights of way, easements, and restrictions. It is required for various property related transactions and acts as your proof of ownership.

Is a Title Deed The Same as a Title Register?

Prior to the 2002 Land Registry Act, the HM Land Registry used paper based title deeds, which were stored in filing cabinets. With the introduction of this Act, property owners were encouraged to register their property on the new digital HM Land Registry.

Today more than 90% of UK property and land is registered in the digital HM Land Registry database. Very few properties still require original title deeds.

Why Do I Need a Title Register?

As a property owner, you should have an up-to-date copy of your Title Register and title plan stored away in a safe place. If you’re planning building work such as an extension, conservatory, or structural changes to your property you will need them.

If you’re involved in a legal dispute with a neighbour a Title Register and a title plan will be required to start legal proceedings. Common disputes include:

- Property boundary disagreements.

- Maintenance issues concerning fences, bushes, or walls.

Additionally, most lenders will also require a copy of your Title Register and title plan if you’re securing assets or money against your home.

What’s Included in a Title Register?

📄 Download a HM Land Registry Title Register Sample (PDF): Title Register Sample PDF

A Title Register is a one or two page legal document that includes important information relating to the property, its owner(s), and any charges against the property. It’s split into 3 sections:

Section A: The Property in a Title Register

Section A of a title deed contains information about a property and any land included with the property:

- Property Title Number: The property title number is an identification number used to locate a property in the HM Land Registry database. It’s like a fingerprint. No two properties have the same title number.

- Property Information: Includes a brief description of the property and land such as its location, boundaries, or specific features.

- Easements and Rights: Legal rights that allow a person to use another person’s land for a specific purpose such as access to utilities and drainage.

- Ownership Rights: Indicates whether the property is freehold (full ownership of land and property) or leasehold (ownership of the building or land for a set number of years).

Types of Easements

There are several different types of easements that have different meanings that are important to understand:

- Dominant Tenement: The property that benefits from the easement.

- Servient Tenement: The property that is burdened by the easement.

- Express Easement: An easement that is written into a legal document. For example a land owner selling part of their land and includes written right of way in the contract.

- Implied Easement: An easement that is not written down. For example an easement that has been used for a purpose for a long time, or due to necessity.

- Prescriptive Easement: An easement that has been used for a long time without permission (usually 20+ years).

- Negative Easement: An easement that prevents the owner from doing something on their land. For example, building something that blocks light through a neighbouring building.

Examples of Easements

- Right of Way: Allows somebody to pass over another person’s land. For example shared driveways or a footpath that crosses a field.

- Utility Easements: Allows utility (gas, electric, telephone) companies to install and maintain pipes and wires.

- Drainage Easement: Grants the use of another person’s property to run drainage pipes or channels.

- Light Easement: The right to receive light through a window.

- Air Easement: The right to access airspace over a property.

- Right to Maintain Boundary Walls or Fences: Allows the property owner to enter neighbouring land to maintain or repair shared structures.

Section B: Property Ownership in a Title Register

- Ownership: This section lists the name(s) of the legal property owner(s).

- Title Class: Whether the property or land is absolute or possessory (see below).

- Restrictions: Shows any restrictions on the property owners power to deal with the property, for example:

- How the property can be used (commercial, residential, industrial).

- Deed restrictions detailing private agreements attached to the property (also called covenants).

- Rules outlining property restrictions including: mortgage restrictions, restrictive covenants, restrictive easements, right of pre-emption, title conditions, planning conditions, consent for leasing/letting, charges or liens, bankruptcy or insolvency, due to a court order, and public rights of way.

Types of Title Class

The title class of a property defines the level of ownership and legal rights the owner has over a property. This determines how secure or indefeasible the title is, and affects how easily it is to sell or remortgage a property. Buyers and lenders prefer absolute titles.

- Absolute Title: Strongest most secure class of title. Confirms full legal ownership.

- Possessory Title: Granted when a person has no documents to prove ownership such as Title Register and title plan. Can be upgraded to absolute after 12 years under certain conditions. May be challenged by somebody with better claim of ownership.

- Qualified Title: Rarely used. Used when there is a legal defect or uncertainty in a title. Ownership is subject to specific limitations mentioned in the register. Can raise red flags in conveyancing.

- Good Leasehold Title: Specific to leasehold properties. Confirms the lease is valid, but does not guarantee that the freeholder’s title is sound. Can also raise red flags in conveyancing.

Section C: Charges Against Property in a Title Register

This section lists any financial burdens tied to the property that may affect its value or resale. For example debts or claims against a property.

Charges against the property can complicate the sale or remortgaging of the property, as they must be cleared or addressed before the transaction can proceed. Types of charges include:

- Mortgage Charges

- Equitable Charges

- Charging Orders

- Land Charges

- Judgement Charges

- Statutory Charges

- Fixed Charges

- Floating Charges

- Legal Liens

- Tax Liens

How to Get a Copy of a Title Register

At Property Documents Ltd we provide official copies of Title Register documents. We’re an authorised provider of HM Land Registry Title Register documents.

We’re fast, and affordable. Paper copies are posted at 5pm via next day delivery on the day of the order. Digital copies are sent within 24 hours as PDF files.

🛒 Order Now:

FAQ

Do I Need a Title Register If I Have a Title Deed?

Yes.

If your property isn’t on the Title Register you should call the HM Land Registry to get it added. This helps protect you from property fraud/theft through misrepresentation. Every year the Land Registry has prevented numerous cases of Title Registry fraud. Don’t become a target.

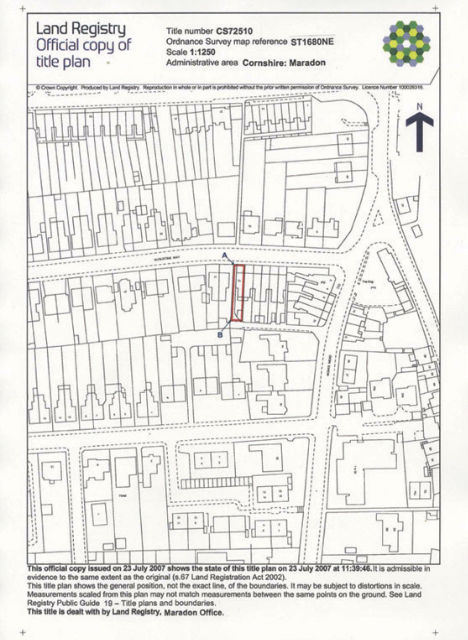

What’s The Difference Between a Title Register and a Title Plan?

A title register is a legal document that contains information about the property owner(s), property details, easements, and boundaries in written form. A title plan is a visual document that complements a title plan. It shows general boundaries, outlines, and property features in map form.

How Do I Correct Errors On My Title Register?

Contact the HM Land Registry using their online contact form: https://www.gov.uk/guidance/contact-hm-land-registry

Reviews

There are no reviews yet.